2274897 - 2274897 - LC. The new provisions indicates that if the EPF is not used for buying an annuity then 60 of that portion of the corpus which is built from the.

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

KUALA LUMPUR 28 January 2016.

. Therefore forces should budget as though there were an employer contribution rate of 242 of pensionable pay for 201516. PRESENT RATES OF CONTRIBUTION BY CONTRIBUTION ACCOUNTS ADMINISTRATION ACCOUNTS EPF EDLIEPS EMPLOYEE 12 10 0 0 0 0 EMPLOYER Difference of EE share and Pension Contribution 833 05 050. Employer contribution Employee provident fund AC 1 12.

Employees Deposit linked insurance AC 21 0. 20 on annual earnings above the PAYE tax threshold and up to 32000. CPF Contribution Rate From 1 January 2016 Table for Private Sector Non-Pensionable Employees Ministries Statutory Bodies Aided Schools For Singapore Permanent Residents SPR during 2nd year of SPR status under Full Employer Graduated Employee contribution rates FG Employees Age Years Employees total wages.

On 30 June 2022 the Employees Provident Fund EPF announced that the employees contribution rate below 60 years old is now 11 effective from July 2022 s salary and contribution starts from the month of August 2022 onwards. 500- EDLIS Administrative charges AC-22 0. 13 Ref Contribution Rate Section A Applicable for ii and iii only Employees share.

Employee EPF contribution RM 6600 8 RM 528. Please click herefor further details. The employees contribution goes directly to the EPF account.

Employer Contribution to EPF The employer contributes 12 of salary which is distributed as 833 towards the Employees Pension Scheme and 367 towards the Employees Provident Fund. Observers said this was another move by the government to nudge employers to shift to the NPS from the EPF. A percentage of the employers contribution goes towards EPS which.

For employees with monthly wages exceeding RM20000 the employees contribution rate shall be 9 while the rate of contribution by the employer is 12. Payroll from March 2016 onwards should calculated at 11 as below. 65 Ref Contribution Rate Section C More than RM5000.

Employers contribution towards EPF 367 of Rs. Senior Citizen Age 61. EPF - Employees Contribution Rate Reverts to 11.

01-04-2017 10 rate is applicable for Any establishment in which less than 20 employees are. 065 From 01042017 Previous-085 from Jan 2015 or min Rs. The employer contribution for the employee is at 13 and 12 depending on the salary of the employee.

050 EPF Administrative charges AC 2 0. 02 Employee contribution rates. Payroll for Jan and Feb 2016 should be calculated at 55 as below.

The EPF Board Malaysia has announce a decrease of Employee Contribution Rate from 11 to 8 while for Senior Citizen it will be changed from 55 to 4. 367 Employees Pension scheme AC 10 0. The interest rate for EPF is reviewed by the Employees Provident Fund Organisations EPFO.

CPF Contribution Ordinary Account Special Account Medisave Account 35 below 100 6217 100 2162 1621 1621 100 x 01621 2162 100 x 02162 Annex C Private Sector Non-Pensionable Employees Statutory Bodies Aided Schools Graduated Employer Employee GG Contribution Rate From 1 January 2016 Table for. However there are changes on the EPF contribution rates starting January 2021 the full article. It is equivalent to 12 of the basic pay plus dearness allowance plus retaining allowance.

Prima facie the Budget 2016 has proposed making 60 of employee contribution EPF corpus taxable for contributions after 142016. The standard practice for EPF contribution by employer and employee are. If there are less than 10 employees in the organisation and the employer contribution 10 even the employee will contribute 10.

As of now employers claim the full contribution to the EPF as a business expense. 12 Ref Contribution Rate Section A. From April 2016 a maximum Rs 15 lakh will be allowed per employee said Balwant Jain tax expert.

EPF Interest Rate is decided by the government. An employee with a salary less than RM5000 will have employer contribution of 13 while more than RM5000 salary the employer contribution is 12. 40 on annual earnings from 32001 to 150000.

Till now withdrawal of EPF corpus after 5 years of continuous service was fully tax exempt. This include 833 contribution to Pension Scheme. Both employer and employee contribute 12 of the employees basic salary towards the EPF.

Ref Contribution Rate Section E RM5000 and below. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF. Every year the government.

In addition to this Employer has to pay 085 as admin charge 05 as EDLI and 01 as EDLI admin charges. 1208505001 1336 AbbasPS 17th March 2016 From India Bangalore. Additionally the employer also contributes 050 towards the Employees Deposit Linked Insurance EDLI account of the employee.

Following Prime Minister YAB Datuk Seri Najib Tun Abdul Razaks announcement during the presentation of the revision of Budget 2016 today the Employees Provident Fund EPF announces the reduction in the employees monthly statutory contribution rate from 11 to 8 for members below age 60 and 55 to 4 for those age 60. 001 or min Rs. Employer contribution is 12 on employee salary.

Basic tax rate. Reduction in Employees EPF Statutory Contribution Rate 2016.

Confluence Mobile Support Wiki

St Partners Plt Chartered Accountants Malaysia Epf Monthly Contribution Rate For 2021 Is Available To Download The Third Schedule Please Click At Below Link Https Www Kwsp Gov My Documents 20126 927226 Bi Jadual Ketiga 2020 Kwsp Pdf

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Budgeting Personal Finance Tax

Income Tax Ppt Revised Income Income Tax Tax

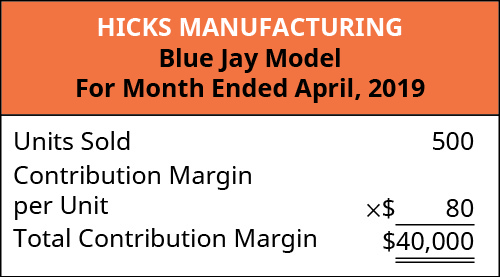

Explain Contribution Margin And Calculate Contribution Margin Per Unit Contribution Margin Ratio And Total Contribution Margin Principles Of Accounting Volume 2 Managerial Accounting

Epf Employer Contribution Advisory Services Employer Covid 19 Assistance Programme E Cap Yau Co

Pin On Excel Utility To Prepare Ecr Ii

How To Save Capital Gains Tax On Property Sale

Confluence Mobile Support Wiki

Tax Shield Your Retirement Corpus

Confluence Mobile Support Wiki

Cash Management Guidelines Ministry Of Finance Clarification Dtd 17th February 2021 Cash Management Management Finance

Epf Contribution Rate 2016 8 Or 11 Imoney

Confluence Mobile Support Wiki

Removal Of Sixty Four 64 Hcos Empanelled Under Cghs Delhi Ncr W E F 02 05 2022 Https Www Staffnews In 2022 05 Removal Of Sixty Four In 2022 Delhi Ncr Ncr Sixties

Basic Salary More Than 15000 Eps Contribution Rejection Of Transfer Or Epf Claim